“I’ve got a 2-cent dollar to help you pay what needs to be paid“

– Ben Feldman

Forget What You Think You Know About Life Insurance

In today’s world, life insurance has such a bad stigma. So much so that many of the business owners I talk to shy away from the conversation entirely. Over the years, you’ve had financial advisors and life insurance producers push products that you truly don’t need. Or, products that weren’t properly explained to you. So when the topic comes up from a business perspective, I understand the initial skepticism. The problem however, is that there are issues in business like employee retention, ownership transfer, and asset protection that can be effectively solved with life insurance. The solution is simple – you need to work with someone who specializes in life insurance solutions for businesses. There are benefits that are either unattainable or unaffordable for small businesses through any other outlet that life insurance can provide.

One of my favorite sayings about life insurance is from Ben Feldman, the all-time life insurance salesman from the 60’s: “Let insurance dollars pay for what has to be paid because it’s a discounted dollar.” When compared to the actual cost of whatever goal you’re trying to achieve – life insurance is the most affordable outlet in many business situations.

Here are 3 ways that every business should be using life insurance.

1. Buy/Sell Funding: Preserving Business Ownership with Life Insurance

What it is: Buy/Sell Funding is a strategy that enables business owners to plan for the orderly transfer of ownership in the event of an owner’s death or departure.

What it accomplishes: This approach ensures a smooth transition by funding the buyout of the deceased owner’s interest in the business.

Why it’s important: Without a Buy/Sell Agreement funded by life insurance, surviving owners may face financial hardships, disputes with the deceased owner’s family, or even the potential dissolution of the business.

What you risk by not using it: Without this funding mechanism, your business may be left without a clear plan for succession, leading to uncertainty, potential legal battles, and a disruption in day-to-day operations.

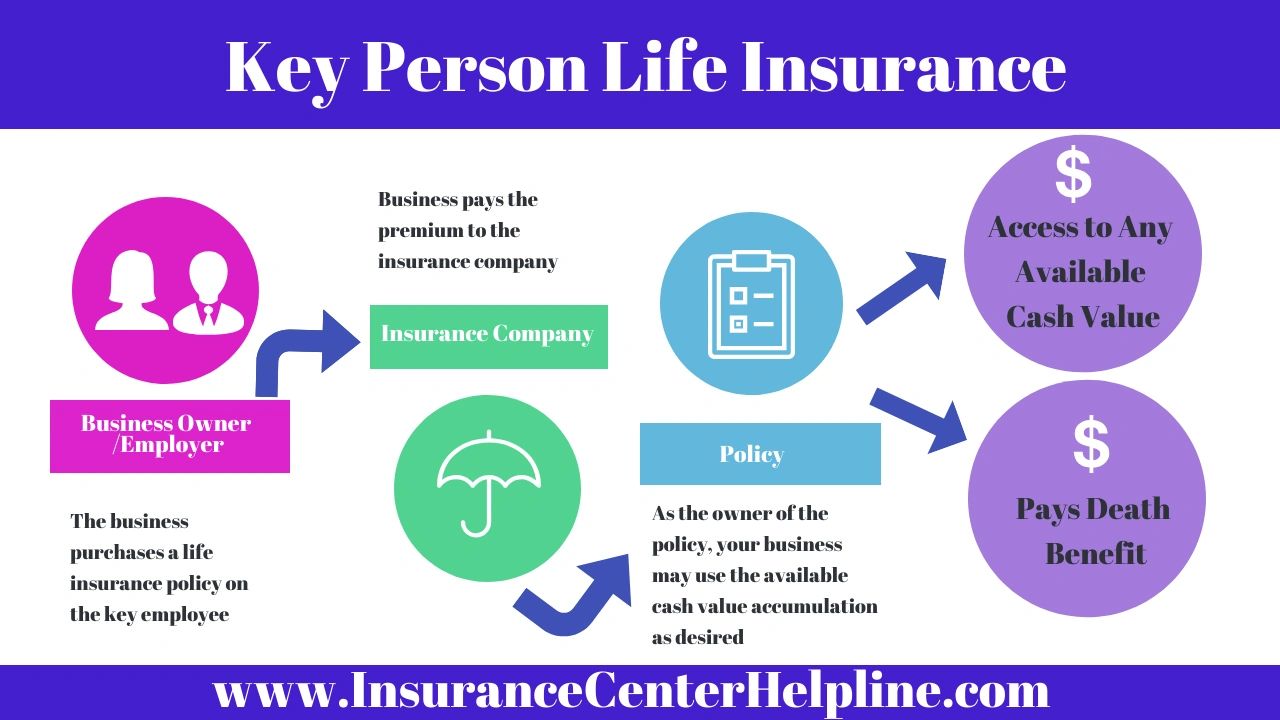

2. Key Person Protection: Safeguarding Business Stability with Life Insurance

What it is: Key Person Protection is a strategy where a business insures its key employees or owners whose expertise, skills, or leadership are vital to its success.

What it accomplishes: In the unfortunate event of the death of a key person, the business receives a payout to cover expenses like recruiting and training a replacement, as well as offsetting potential revenue losses. More importantly, it also provides a benefit to the family of your employee that truly shows how much you value them and their contributions to your business.

Why it’s important: Losing a key employee can be devastating to a business’s profitability and continuity. Key Person Protection helps mitigate these risks.

What you risk by not using it: Without Key Person Protection, your business may struggle to recover from the loss of a key individual, impacting revenue, client relationships, and overall stability.

3. Deferred Compensation (Executive Bonus Plans): Retaining Top Talent

What it is: Deferred Compensation, often facilitated through Executive Bonus Plans, is a method for businesses to attract and retain key employees by offering retirement or bonus benefits tied to specific events, such as retirement or death.

What it accomplishes: This strategy provides an incentive for key employees to stay with the company while also offering them additional financial security. It’s important to understand that this benefit does not have to be offered to every single employee (referred to as a non-qualified plan).

Why it’s important: In today’s competitive job market, retaining top talent is crucial. Deferred Compensation plans give employees a reason to commit to your business long-term. It also will help with attracting new employees as you’ll be able to offer a benefit that very few of your competitors offer.

What you risk by not using it: Without these plans, your business may struggle to find, retain, and motivate key employees, leading to talent attrition and potential disruptions in operations.

The Bottom Line

Whether you want to ensure a smooth ownership transition, replace a key employee, or attract and retain good employees – life insurance is an option that you need to seriously consider. In today’s world of shrinking labor pools and high inflation, you can accomplish all of those things through life insurance. Every business’ needs are unique. But the beautiful thing about life insurance is that it can provide an array of solutions. If you’re struggling with finding, replacing, or keeping key employees – I’d encourage you to explore how life insurance can fit into your plans moving forward.

If you’d like to learn more about how we’re able to guarantee the successful transition of a business, attract some of your industry’s top talent, or safeguard your most valuable asset (your employees), McHugh Insurance Group is here to help.