How Life Insurance Can Become A Valuable Part of Your Employee Benefit Programs

Due to a shrinking labor pool and the inability to compete with compensation plans offered by larger companies, small businesses continue to struggle with finding and retaining key employees. Outside of hourly wages/salaries, one benefit that many small businesses lack compared to their larger competitors is life insurance and disability benefits.

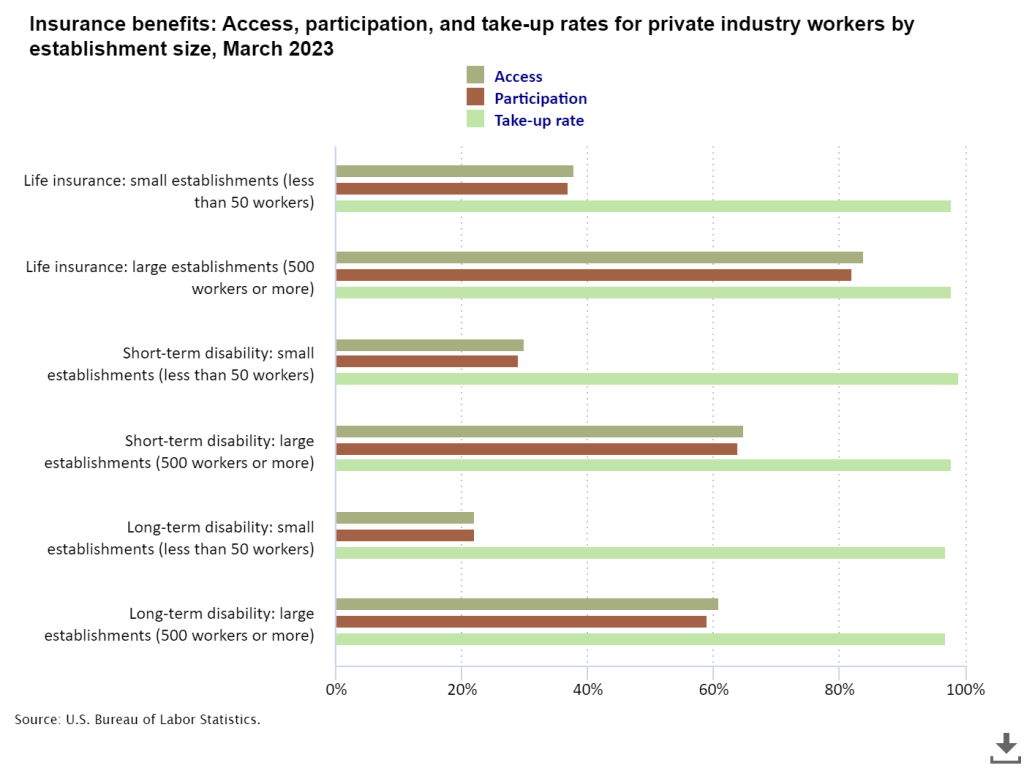

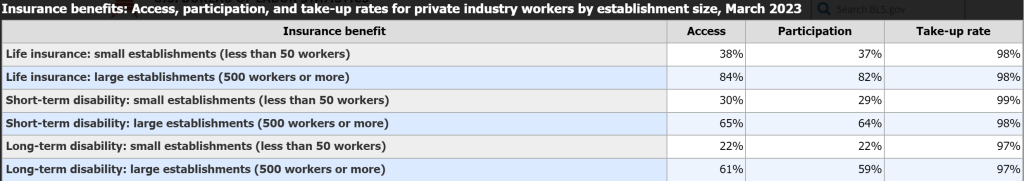

This chart from the BLS highlights the percentage of businesses that offer these benefits and of those that do, what percentage of their employees participate.

Key Statistics

- 38% of small businesses offer life insurance benefits compared to 84% of larger establishments (46% less)

- Only 26% of small businesses offer any type of disability insurance benefit which is 37% less than larger establishments

- The “take-up” rate shows that when life or disability insurance is offered, 97-99% of employees will take advantage of it.

Obviously, it’s much less expensive for larger companies to offer these benefits due to having more employees and more buying power. However, small businesses should take note of the fact that almost every single employee – at any level – will take advantage of this benefit when offered.

Losing any employee is a setback. But, losing a key employee is often devastating for small businesses. There is a common misconception that if you offer these benefits to one employee, you have to offer it to everyone. However, that is not always the case.

One of the most effective ways for small businesses to hire and retain top talent is with nonqualified plans designed specifically for key employees. To learn more about how these programs work and how they can help you attract and retain employees, contact Hunter McHugh at hunter@mchughinsurancegroup.com.